What Happens If a Stolen Car Is Found After an Insurance Payout?

It’s a bizarre mix of relief and confusion. Weeks or even months after your car was stolen, and after you’ve gone through the entire claims process and received a check from your insurance company, you get a call from the police: “We’ve found your vehicle.” While your first instinct might be joy, it immediately raises a cascade of practical and financial questions. Who owns the car now? Do you have to give the money back? Can you even get the car back? This is a surprisingly common scenario, and navigating it correctly is crucial. This guide will walk you through the entire process, explaining who owns the car and what options you have.

The Bottom Line: The Insurance Company Owns the Car

Once your insurance company has paid out a total loss claim for your stolen vehicle, they have legally purchased the asset from you. **You have traded the title for the settlement check.** Therefore, the recovered car now belongs to the insurance company. From this point forward, you will have two primary options: keep the money and let them have the car, or work with them to return the money and get your car back, often with a salvage title.

Understanding the Process: From Stolen to Settled

To understand the situation, it helps to recap the journey that led to this point. When your car was first stolen, you (hopefully) took the correct steps. The process of how to file a claim with your car insurance provider for a stolen vehicle involves several key stages:

- Police Report: You filed a report with the police, which is the essential first step.

- Insurance Claim: You opened a claim under the comprehensive portion of your auto insurance policy.

- Waiting Period: Most insurers have a mandatory waiting period (typically 14 to 30 days) to see if the police can recover the vehicle quickly.

- Total Loss Settlement: After the waiting period, the insurer declared the car a total loss. They calculated its Actual Cash Value (ACV), subtracted your deductible, and paid you the settlement amount.

- Title Transfer: As a final step in the claim, you signed over the vehicle’s title to the insurance company. This is the critical transaction. You no longer legally own the car.

This process is why, when the police call you, your next call must be to your insurance adjuster. The car is their property to recover, not yours.

“The settlement of a total loss claim, whether from theft or damage, is fundamentally a sale. The policyholder sells the vehicle to the insurer in its ‘as-is, where-is’ condition in exchange for an agreed-upon value. Legal ownership is transferred at that point.”

The Phone Call: What to Do When the Police Find Your Car

When you receive the call from law enforcement, remain calm and gather information. Ask about the car’s general condition (if they know it), its location, and which officer is handling the case. Then, immediately contact your insurance company’s claims department. They will take over the process of liaising with the police, arranging for towing, and securing the vehicle at an impound or storage yard.

Once the insurer has the car, an adjuster will perform a thorough inspection to assess its condition. This assessment is the most important factor in determining your options.

Your Two Main Options: A Critical Decision

After the adjuster’s inspection, the insurance company will present you with a choice. As of August 2025, this process is fairly standardized across the U.S. insurance industry. You will need to decide between keeping the money or keeping the car.

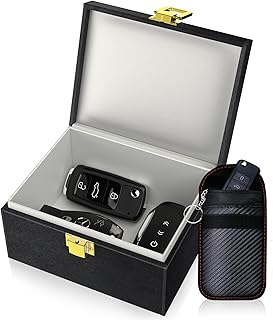

Featured Product: Prevent Theft Before It Happens

Modern car theft often involves “relay attacks,” where thieves amplify your key fob’s signal to unlock and start your car. A **Faraday Box** is a signal-blocking container where you can store your keys at home. This simple, effective security measure prevents thieves from hijacking your key’s signal, making it one of the best preventative tools on the market today.

View on AmazonThe Major Hurdle: Understanding the Salvage Title

A salvage title is a permanent brand on a vehicle’s history, indicating that an insurance company has declared it a total loss. This has serious long-term consequences that you must consider before choosing to take your car back.

- Difficulty Getting Insurance: Many standard insurance carriers will not offer full coverage on a salvage-titled vehicle. You may be limited to liability-only policies, or you may have to seek out a high-risk, non-standard insurer. This can be especially problematic if a young driver is on the policy, as the combination of a salvage vehicle and a high-risk driver can make finding affordable car insurance for teens nearly impossible.

- Significantly Reduced Resale Value: The car’s value is permanently diminished, often by 20-40% or more compared to an identical model with a clean title. Many buyers are wary of salvage titles, making the car extremely difficult to sell or trade in.

- Inspection and Rebuilding Process: Before the car can be legally driven again, most states require it to pass a rigorous safety inspection to be issued a “rebuilt” title. This can be a time-consuming and potentially costly process.

Featured Product: A Classic, Visual Deterrent

Sometimes, the best defense is a simple one. A highly visible **Steering Wheel Lock** like this one from The Club is a powerful deterrent. Opportunistic thieves are looking for easy targets, and the sight of a sturdy lock often convinces them to move on to a car that’s less trouble. It’s a low-tech, high-impact layer of security for any vehicle.

Frequently Asked Questions (FAQ)

1. What if my car is found before the insurance company pays me?

If the car is recovered during the waiting period before the claim is settled, the process is different. The claim is no longer a total theft loss. You would take possession of your car, and the comprehensive coverage would pay for any damage caused by the thieves (minus your deductible).

2. Do I have to pay the impound and storage fees for the recovered car?

No. Since the insurance company is the legal owner of the vehicle after the payout, they are responsible for all costs associated with its recovery, including towing and storage fees.

3. What happens to the loan on the car if I let the insurance company keep it?

The settlement check you received was used (or should have been used) to pay off the remaining balance of your auto loan. If the ACV was more than you owed, you would have kept the difference. If it was less, your Gap insurance (if you had it) would have covered the deficit. For you, the loan is paid and the transaction is complete.

4. Can I negotiate with the insurance company on the “buy-back” price?

Generally, no. The “buy-back” price is simply the full settlement amount they paid you. However, if the car is significantly damaged, you may be able to negotiate a lower price based on the car’s new salvage value, but this is at the insurer’s discretion.

Disclaimer: This article provides general information about standard insurance practices in the U.S. as of August 2025 and does not constitute legal or financial advice. Policy terms and state regulations can vary. It is essential to speak directly with your insurance claims adjuster to understand your specific options and contractual obligations. The products mentioned may contain affiliate links.