Is It Illegal to Not Report a Car Accident to Insurance? What You Need to Know

In the stressful moments after a minor fender bender, you might be tempted to handle things “off the books.” The other driver seems agreeable, the damage looks minimal, and you both want to avoid the hassle and potential rate hikes from involving insurance. But is this quiet agreement actually legal? And what are the hidden risks? The answer is more complex than a simple “yes” or “no,” involving a crucial distinction between the law of the state and the terms of your insurance contract.

Key Takeaways

- Is it Illegal? Generally, it is not “illegal” in a criminal sense to not report a minor accident to your *insurance company*. However, it is often illegal to not report an accident to the **police or DMV** if there are injuries or if the property damage exceeds a certain state-mandated dollar amount.

- Contractual Obligation:** Your insurance policy is a legally binding contract that almost certainly **requires you to report all accidents promptly**. Failing to do so is a breach of contract.

- The Biggest Risk:** The primary danger of not reporting an accident is that your insurance company could **deny your claim** if the other driver later reports an injury or claims more severe damage. This could leave you personally liable for all costs.

- State vs. Insurer:** You must understand the two separate reporting duties: your legal duty to the state (police/DMV) and your contractual duty to your insurer. They are not the same.

The Law vs. Your Policy: Understanding Your Two Duties

This is the most critical concept to grasp. When you have an accident, you have two separate and distinct obligations that are often confused with one another.

1. Your Legal Duty to Report to the State (Police/DMV)

This is a matter of state law. Every state has laws requiring drivers to report accidents to the police or the Department of Motor Vehicles (DMV) under certain circumstances. As outlined by resources like **DMV.org**, these requirements are typically triggered by:

- Any Injury or Death: If anyone involved in the accident, including passengers or pedestrians, is injured or killed, you must report the accident to the police immediately. Leaving the scene of an accident with injuries is a serious crime.

- Property Damage Exceeding a Threshold: Every state sets a minimum dollar amount for property damage that legally requires a report. This threshold varies widely. For example, it might be $500 in one state and $2,500 in another. Any damage exceeding this amount must be reported.

Failing to file a required report with the DMV or police is illegal and can result in fines, license suspension, and even jail time, especially in accidents involving injuries.

2. Your Contractual Duty to Report to Your Insurance Company

This is a matter of contract law. Your auto insurance policy is a contract between you and your insurer. As the **Insurance Information Institute (III)** emphasizes, this contract contains a “notice of occurrence” or “prompt notice” clause. This clause legally obligates you to inform the company of any incident that could potentially lead to a claim. It doesn’t matter if the damage is $50 or $50,000; the duty to inform them exists.

| Reporting Duty | To Whom? | Why? | Consequence of Failure |

|---|---|---|---|

| Legal Duty | Police / DMV | To comply with state traffic and safety laws. | Illegal. Can result in fines, points on license, license suspension. |

| Contractual Duty | Your Insurance Company | To uphold the terms of your insurance policy. | Breach of Contract. Can result in claim denial, non-renewal, or policy cancellation. |

“Your insurance contract is predicated on a principle of utmost good faith. Part of that faith is fulfilling your duty to promptly inform the insurer of any event that could trigger coverage. This allows them to investigate the facts while they are still fresh.”

Why Do People Avoid Reporting Minor Accidents?

Despite the risks, many drivers are tempted by the idea of a “handshake deal.” The motivations are usually financial and logistical:

- Fear of Premium Increases: This is the number one reason. Drivers worry that even a small claim will cause their insurance rates to skyrocket for years to come.

- Avoiding the Deductible: If the damage seems less than their deductible (e.g., a $700 repair with a $1,000 deductible), they feel there’s no point in filing a claim.

- Maintaining a “Clean” Record: Some drivers pride themselves on being claims-free and don’t want to blemish their record.

- Perceived Hassle: The process of filing a claim, getting estimates, and dealing with adjusters can seem like a time-consuming burden.

- Trust in the Other Driver: The other party may seem honest and agree to pay for damages out of pocket, leading to a false sense of security.

Featured Product: The Ultimate Objective Witness

Uncertainty fuels bad decisions. A dash cam eliminates guesswork by providing indisputable video evidence of an accident. The Vantrue N4 Pro 4K Dash Cam records the front, rear, and cabin, capturing every detail. This footage is invaluable for protecting you from fraudulent claims and providing your insurer with a clear picture of what happened, making the reporting process smoother and more factual.

The High-Stakes Gamble: What Are the Real Risks of Not Reporting?

While avoiding a premium hike is tempting, a handshake deal is a significant gamble where you shoulder all the risk. Here’s what can—and often does—go wrong.

1. The Other Driver Changes Their Story

The friendly driver at the scene can become a different person days later. They may discover the “minor” damage is actually a $3,000 repair involving hidden structural components. Or, they might wake up with a sore neck and decide to claim a personal injury. They can then file a claim with your insurer. Because you failed to report the incident promptly, your insurer might deny the claim, leaving you personally responsible for all repair costs and medical bills.

2. Breach of Contract and Denial of Coverage

This is the most severe financial risk. When the other driver files a claim weeks or months later, your insurance company’s ability to investigate is compromised. Witnesses may be gone, evidence may be lost, and memories fade. Because you violated the “prompt notice” clause in your contract, the insurer has the right to deny coverage for the entire incident. This means you are effectively uninsured for that accident. The consequences of driving without car insurance are suddenly your reality, and you could be sued directly for all damages.

3. Hidden Damages and Delayed Injuries

Modern cars are designed with complex crumple zones and sensors. A seemingly minor tap to the bumper could hide thousands of dollars in damage to sensors, cameras, and support structures. Furthermore, some common accident-related injuries, like whiplash, may not show symptoms for days or even weeks.

4. Policy Non-Renewal or Cancellation

Even if they eventually cover the claim, your insurer may view you as a high-risk client for failing to adhere to the policy terms. This could lead them to not renew your policy at the end of its term, forcing you to seek coverage elsewhere, potentially at a much higher rate.

The Recommended Course of Action After Any Accident

To protect yourself legally and financially, experts from the NAIC and III recommend a consistent approach, no matter how minor the accident seems.

- Ensure Safety: Move vehicles out of traffic if possible. Turn on hazard lights. Check for injuries.

- Call the Police: Even in a minor incident, a police report is an invaluable, objective third-party record of the event. It documents the facts, parties involved, and conditions at the scene. This can be crucial if disputes arise later.

- Exchange Information: Get the other driver’s name, address, phone number, license plate number, driver’s license number, and insurance company/policy number. Provide them with your information as well.

- Document Everything: Use your smartphone to take pictures of both cars from all angles, the accident scene, traffic signs, and weather conditions. Note the time and date.

- Do Not Admit Fault: Stick to the facts of what happened. Avoid saying things like “I’m so sorry, it was my fault.” Let the police and insurers determine liability.

- Notify Your Insurer Promptly: Call your insurance agent or the company’s claims hotline as soon as possible. Reporting the accident is not the same as filing a claim. You can inform them of the incident and then decide later if you want to actually file a claim to pay for damages. This fulfills your contractual duty and protects your right to coverage.

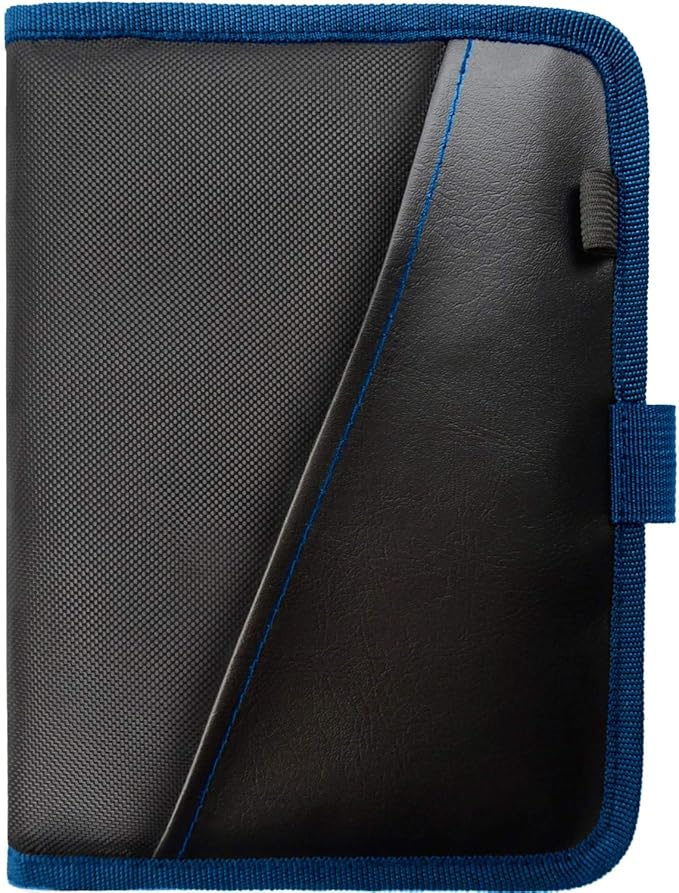

Featured Product: Be Prepared with an Accident Report Kit

In the chaos of an accident, it’s easy to forget what information to collect. The BLUEMEG Car Glove Box Organizer comes with a notepad and pen, providing a dedicated space to keep your documents and a place to write down all the crucial details. This ensures you gather everything your insurer needs, from the other driver’s info to witness contacts, fulfilling your “duty to cooperate” effectively.

View on AmazonFrequently Asked Questions (FAQ)

1. If I report an accident, will my insurance rates definitely go up?

Not necessarily. Many insurance companies offer “accident forgiveness” for a first minor accident. Additionally, if you are not at fault, your rates are less likely to increase. Reporting an incident just to be safe does not automatically trigger a rate hike, especially if no claim is paid out.

2. What if the accident was on private property, like a parking lot?

Your duties remain the same. State laws still apply to property damage and injuries, and your insurance contract requires you to report any incident that could lead to a claim. It’s wise to report it, as parking lot accidents often lead to disputes over who was at fault.

3. What if I hit a parked car and the owner isn’t there?

Legally, you must make a reasonable effort to find the owner. If you cannot, you are required to leave a note in a secure place with your name, contact information, and a brief explanation. Leaving the scene without doing so is considered a hit-and-run, which is a crime. You should also report this to your insurer.

4. Can my insurance company cancel my policy for not reporting an accident?

Yes. While non-renewal is more common, if the insurer determines that your failure to report was a material misrepresentation or a significant breach of the cooperation clause, they may have grounds to cancel your policy outright. This is why understanding your duties as a policyholder within the broader context of car insurance for United States residents is so important.

Disclaimer: This article is for informational purposes and does not constitute legal advice. It is based on information from the Insurance Information Institute (III), DMV.org, and the National Association of Insurance Commissioners (NAIC). Laws and policy terms vary. Always consult your state’s laws and your insurance policy, and speak with a licensed professional for advice on your specific situation. The products mentioned may contain affiliate links.